Real Estate Commission Management Software For Brokerages & Leasing Teams

Automate back-office operations, manage invoices & agent payments and leverage powerful, real-time business analytics.

A real estate commission tracking software and back-office solution for pure brokerages and the brokerage divisions of full-service companies

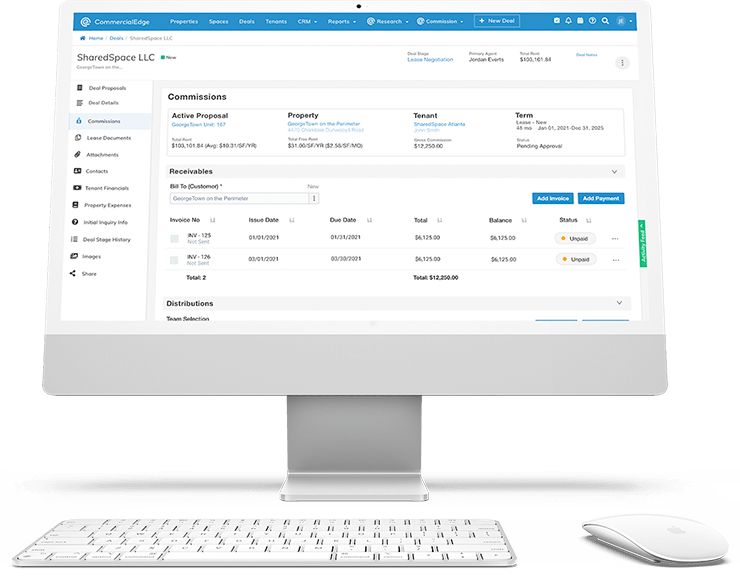

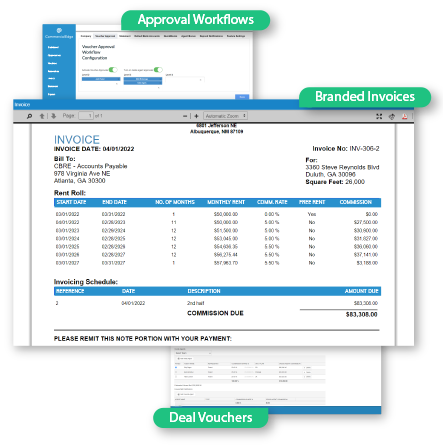

Deal vouchers

Centralize all deal data, documents, invoice dates and commission splits. Replace spreadsheets with digital pipeline tracking and deal vouchers

Commission invoices

Automatically generate and send invoices using customizable templates. Track invoices and monitor due dates with ease

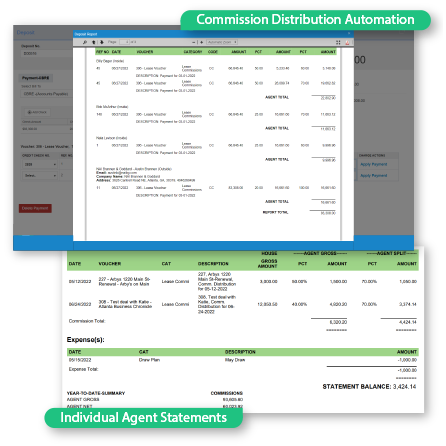

Distribution calculations

Easily automate even the most complex commission distributions, including tiered split plans, overrides, bonuses, outside agents and more

Streamline your back-office with automated operations workflows

- Organize all transactions into digital vouchers with deal data, commission splits, invoice dates, and other key metrics using one dynamic real estate commission tracking software

- Configure your approval workflows with just a few clicks and manage them with ease

- Effortlessly create and send custom branded invoices and download PDFs

- Use our distribution engine to automatically calculate even the most complex splits, tiered plans, manager overrides and more

- Preset update triggers to notify agents when invoices go out, commission checks come in and payments are made

- Leverage our powerful API to connect to Yardi, QuickBooks and Salesforce or set up custom integrations

Gain insight with dashboards and reports built for brokerage teams

- Get a full overview of brokerage financials and agent productivity with a comprehensive global dashboard

- Access a full suite of accounting reports, from deposits to payment history and aged receivables

- Easily download any report to a preformatted PDF or Excel file

- Improve productivity with accurate, real-time data on broker contributions and pipelines

- Automatically update agents when invoices go out, commission checks come in and payments are made.

Configure even the most sophisticated and complex commission rules with ease

- Easily customize flat or tiered split plans based on gross commission, agent net or house net

- Create multiple split plans for each agent and set up complex rule sets that determine plan contributions to specific tiers and break points

- Track out-of-house brokers, pre-split deductions, house fees, manager overrides, internal referral bonuses and intricate split structures

- Manage draw plans for agents and expenses for brokers and deals

- Customize at will to support cash, accrual or hybrid accounting systems

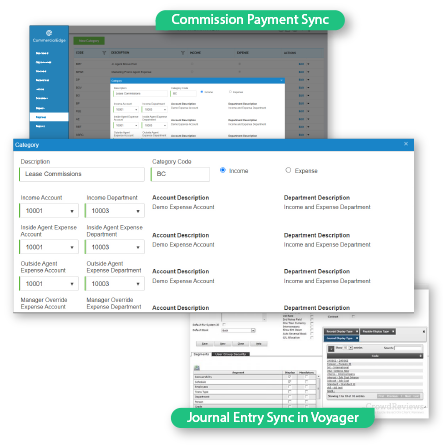

Leverage integrations with Yardi Voyager, Yardi Breeze and CommercialEdge Deal Manager

- Support for cash, accrual or hybrid-based accounting configurations in Voyager and Breeze

- For cash-based accounting, sync journal entries to Voyager and generate payments for in-house and third-party agents

- For accrual-based accounting, sync invoices and accrued agent commission liabilities and trigger the release of payments when commission invoices are paid

- From Voyager and Breeze, easily make commission payments to inside and outside brokers with the Procure to Pay Suite

What clients are saying

CommercialEdge is trusted by

FREE EBOOK

Managing the Financial Complexities of CRE Brokerage Commissions

Uncover how brokerages can optimize financial operations and maintain compliance for both accrual and cash accounting methods.

Read our latest news and insights on CRE accounting

NAI NP Dodge Streamlines Commission Management and Accounting with Advanced CRE Software

CommercialEdge Commissions tracks invoices, monitors due dates and helps configure even the most sophisticated and complex commission rules.

Read More3 Reasons Why Brokerages Should Leverage Multiple Split Plans

Relying on multiple commission split plans can be an effective strategy for recruiting and retaining top agents.

Read More